As someone who’s been in the game for years, I’m excited to share my insights and help you navigate this crucial aspect of freelancing. Trust me, mastering the art of invoicing can make or break your freelance career.

Understanding the Basics of Invoicing

Invoicing isn’t just about asking for money – it’s a dance between you and your clients. Think of it as the grand finale of your hard work, where you present your value and get paid what you’re worth.

But here’s the kicker: many newbie freelancers stumble right out of the gate. They treat invoicing like a chore, slapping together a half-baked bill and wondering why clients drag their feet on payment. Don’t be that freelancer!

Instead, approach invoicing with the same creativity and attention to detail you bring to your work. It’s your chance to showcase your professionalism and make the payment process a breeze for your clients.

| Aspect | Impact on Freelancing Success |

|---|---|

| Cash Flow | Timely invoicing ensures steady income |

| Professionalism | Well-crafted invoices boost your image |

| Legal Protection | Proper documentation safeguards your work |

| Client Relations | Clear invoices lead to happier clients |

| Tax Compliance | Accurate records simplify tax filing |

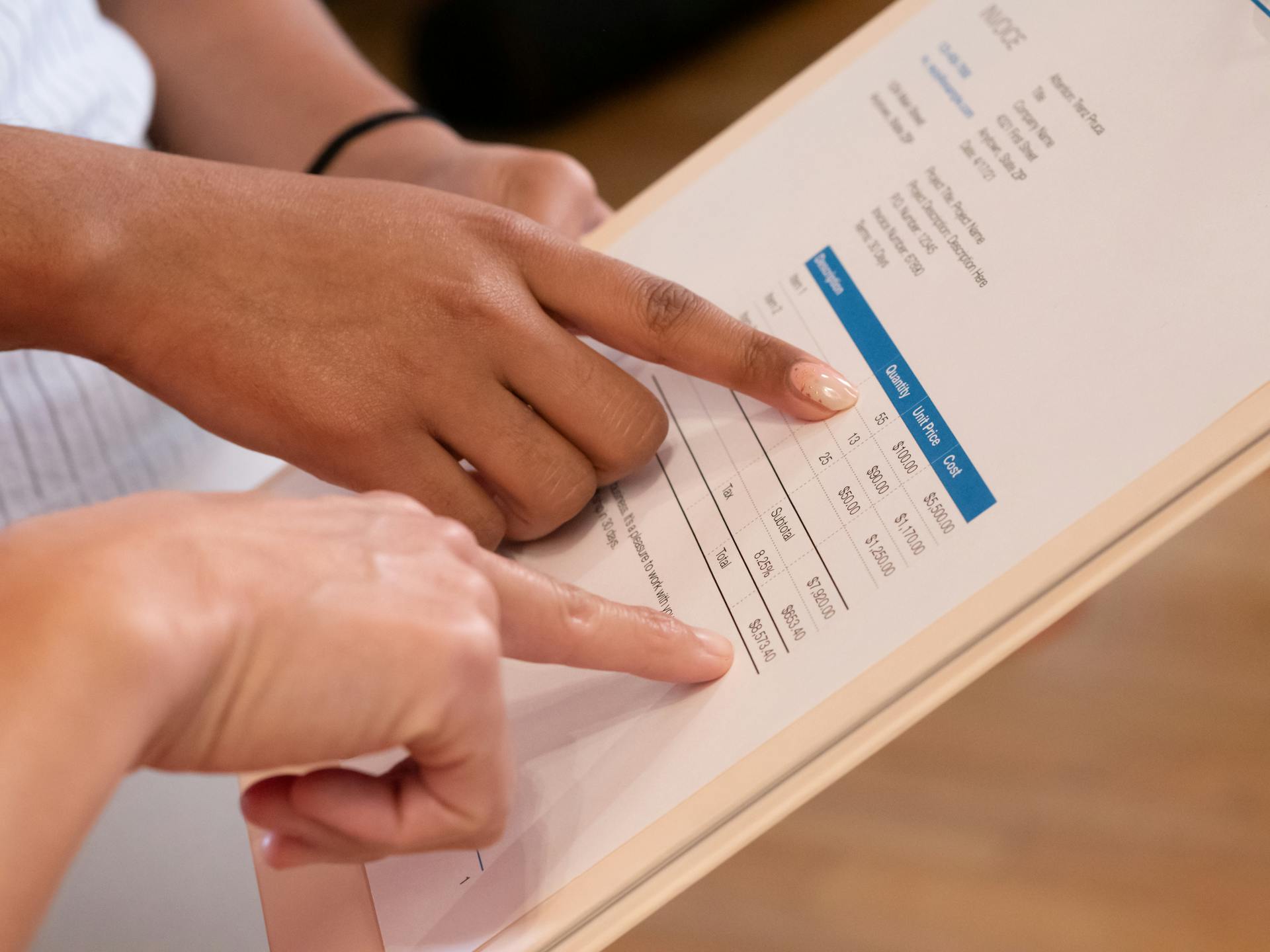

Essential Elements of a Professional Invoice

Your invoice is like your freelance business card – it needs to look sharp and contain all the right info. Here’s what you absolutely must include:

- Your business name and contact details

- Client’s name and address

- Unique invoice number

- Date of issue

- Clear description of services provided

- Itemized breakdown of costs

- Total amount due

- Payment terms and due date

- Accepted payment methods

But don’t stop there! Add a personal touch that sets you apart. Maybe it’s a custom logo, a thoughtful thank-you note, or even a fun fact related to your work. These little extras can turn a mundane invoice into a memorable experience for your client.

Choosing the Right Invoicing Tools

Gone are the days of scribbling invoices on napkins (trust me, I’ve been there). Today, we’ve got a smorgasbord of digital tools to make invoicing a breeze. But with so many options, how do you choose?

First, consider your needs. Are you a solo freelancer juggling a few clients, or are you managing a growing team? Do you need features like time tracking or expense management?

Some popular options include:

- FreshBooks: Great for beginners, with a user-friendly interface

- QuickBooks: Ideal for growing businesses with more complex needs

- Wave: A free option that’s perfect for budget-conscious freelancers

- Invoicely: Offers customizable templates and multi-currency support

Pro tip: Don’t be afraid to test drive a few options before committing. Many tools offer free trials, so take advantage and find the one that feels like a natural extension of your workflow.

Setting Your Rates and Payment Terms

Ah, the million-dollar question (or maybe the hundred-dollar question, depending on your niche): how much should you charge? Setting rates is part art, part science, and a whole lot of self-confidence.

Start by researching industry standards, but don’t be afraid to factor in your unique skills and experience. Remember, you’re not just selling time – you’re selling expertise, creativity, and results.

As for payment terms, clarity is key. Spell out exactly when payment is due (upon receipt, net 15, net 30, etc.) and what happens if a client pays late. Consider offering incentives for early payment or requiring a deposit for large projects.

And here’s a nugget of wisdom I’ve learned the hard way: always, always get your payment terms in writing before starting a project. Your future self will thank you!

Creating a Foolproof Invoicing Process

Consistency is the secret sauce of successful invoicing. Develop a rock-solid process and stick to it like glue. Here’s a basic framework to get you started:

- Complete the project and get client approval

- Generate the invoice using your chosen tool

- Double-check all details for accuracy

- Send the invoice promptly (ideally within 24 hours)

- Follow up politely if payment is late

- Record the payment when received

Sounds simple, right? The magic happens when you turn this process into a habit. Set aside dedicated time each week for invoicing tasks, and watch your cash flow improve.

Dealing with Late Payments and Non-Paying Clients

Even with the best process in place, you’ll inevitably run into payment hiccups. It’s not personal – it’s just part of the freelance game. The key is to handle these situations with grace and firmness.

For late payments:

- Send a friendly reminder a few days before the due date

- Follow up with a polite but firm email if the payment is overdue

- Consider adding late fees for chronic offenders (but communicate this policy upfront)

For non-paying clients:

- Try to understand the reason for non-payment

- Offer a payment plan if appropriate

- As a last resort, consider legal action or using a collection agency

Remember, your time is valuable. Don’t waste endless energy chasing payments – sometimes, it’s better to cut your losses and focus on clients who respect your work and pay on time.

Tax Considerations for Freelancers

Taxes: the word that strikes fear into the hearts of freelancers everywhere. But fear not! With a little organization and know-how, you can tackle taxes like a pro.

First things first: set aside a portion of each payment for taxes. A good rule of thumb is 25-30%, but consult with a tax professional to determine the right amount for your situation.

Keep meticulous records of all income and expenses. Your future self will thank you when tax season rolls around. Consider using accounting software to automate this process and reduce headaches.

And here’s a tip that’s saved my bacon more than once: don’t wait until April to think about taxes. Schedule quarterly check-ins to review your finances and make estimated tax payments if necessary.

Advanced Invoicing Strategies

Ready to level up your invoicing game? Try these advanced tactics:

- Value-based pricing: Instead of charging by the hour, price your services based on the value you provide to the client.

- Retainer agreements: Secure steady income by offering ongoing services for a fixed monthly fee.

- Milestone payments: For large projects, break payments into stages tied to specific deliverables.

- Currency considerations: When working with international clients, decide whether to invoice in your local currency or theirs.

Remember, the goal is to create a win-win situation where you’re fairly compensated and your clients feel they’re getting great value.

Common Invoicing Mistakes to Avoid

Learn from my blunders! Here are some invoicing pitfalls to steer clear of:

- Sending invoices to the wrong person or department

- Forgetting to include all completed work

- Using vague or confusing language to describe services

- Neglecting to follow up on overdue payments

- Inconsistent invoicing schedules

- Failing to keep backup copies of invoices

The good news? These mistakes are easy to avoid with a little attention to detail and a solid invoicing system in place.

Building Strong Client Relationships Through Invoicing

Here’s a mind-bender for you: invoicing isn’t just about getting paid – it’s an opportunity to strengthen client relationships. How? By making the payment process smooth, transparent, and even enjoyable.

Consider adding personal touches like a thank-you note or a quick summary of project highlights. Use clear, friendly language in your invoice communications. And always be open to feedback on your invoicing process.

Remember, happy clients are more likely to pay promptly, refer you to others, and come back for future projects. It’s a virtuous cycle that starts with a well-crafted invoice.

Q&A:

Q: How often should I send invoices?

A: It depends on your project structure and client agreements. For ongoing work, monthly invoicing is common. For project-based work, invoice upon completion or at predetermined milestones.

Q: Should I charge late fees for overdue payments?

A: It’s a personal decision, but many freelancers find that late fees encourage prompt payment. If you choose to implement them, clearly communicate the policy upfront.

Q: Is it okay to offer discounts for early payment?

A: Absolutely! Early payment discounts can improve cash flow and incentivize clients to pay promptly. Just make sure the discount doesn’t cut too deeply into your profits.

Q: How long should I keep copies of my invoices?

A: For tax purposes, it’s generally recommended to keep financial records for at least 3-7 years, depending on your location. Check with a local tax professional for specific requirements in your area.

Q: Can I use the same invoice template for all clients?

A: While using a consistent template is efficient, it’s a good idea to customize certain elements for each client. This might include their preferred payment method or specific project details they require.

Are You Ready to Invoice Like a Pro? Take the Quiz!

- Do you have a dedicated invoicing tool or software? Yes / No

- Have you researched and set clear, value-based rates for your services? Yes / No

- Do you have a consistent process for generating and sending invoices? Yes / No

- Have you established and communicated clear payment terms to your clients? Yes / No

- Do you keep detailed records of all invoices and payments for tax purposes? Yes / No

Scoring:

- 5 Yes answers: You’re an invoicing pro! Keep up the great work and continue refining your process.

- 3-4 Yes answers: You’re on the right track! Focus on improving the areas where you answered No.

- 0-2 Yes answers: There’s room for improvement. Review the article and start implementing these invoicing best practices.

Remember, mastering the art of invoicing is an ongoing process. Keep learning, adapting, and refining your approach. Before you know it, you’ll be invoicing like a seasoned pro and watching your freelance business thrive!